|

Displaying items by tag: price

A new record price for an artwork, nearly $300 million, may have been achieved with the sale of a Paul Gauguin canvas by a Swiss collector. The buyer is rumored to be the Qatar Museums.

The seller, Rudolf Staechelin, a retired Sotheby's executive who now lives in Basel, confirmed the sale this afternoon to the "New York Times," but declined to identify the buyer or disclose the price. The 1892 oil painting, "Nafea Faa Ipoipo (When Will You Marry?)," is one of over 20 works in his collection of Impressionist and Post-Impressionist art. Prior to the sale, the Gauguin canvas had been on loan to the Kunstmuseum in Basel for close to fifty years.

Online retail giant Amazon is expected to launch a virtual art gallery later this year. The website is planning on offering over 1,000 objects from at least 125 galleries. It has been rumored that the online seller of books, electronics and apparel already has over 100 galleries on board. The Seattle-based company has been approaching a litany of galleries across the U.S. in recent months.

The virtual art gallery will follow a similar model as Amazon Wine, which debuted last fall and works with over 400 vineyards and winemakers across the country. Amazon will take a commission from all sales on its art site instead of charging galleries a monthly service fee. Commissions will range from 5% to 15% based on the work’s sale price.

Online art galleries are not unheard of in today’s web-dominated world. Costco currently runs a virtual art gallery that offers prints by artists such as Henri Matisse (1869-1954) and Marc Chagall (1887-1985) as well as original works by lesser-known artists.

Steven Cohen, an American hedge fund manager and founder of SAC Capital Advisors LP, purchased Pablo Picasso’s (1881-1973) La Reve (1932) from casino tycoon Steve Wynn for $155 million. The sale marks the highest price paid by a U.S. collector for an artwork.

Cohen and Wynn have been in discussion about the sale since 2006. Originally, Wynn agreed to sell the painting to Cohen for $139 million but the transaction was cancelled after Wynn, whose vision is compromised, put his elbow through the canvas. The work has since been restored and the repair was factored into the selling price.

The sale comes less than two weeks after SAC Capital settled an ongoing insider trading case with the U.S. Securities and Exchange Commission for $600 million; it was the largest insider trading settlement in history. Cohen, who started collecting art in 2001, has an expansive collection that includes works by Vincent van Gogh (1853-1890), Edouard Manet (1832-1883), Willem de Kooning (1904-1997), Paul Cézanne (1839-1906), Andy Warhol (1928-1987), Jasper Johns (b. 1930), and Gerhard Richter (b. 1932).

When the influential American painter Cy Twombly (1928-2011) passed away two years ago, he left the bulk of his artwork and millions of dollars in cash to the Cy Twombly Foundation of New York. The wealth of money and art passed from a trust to the foundation, which is devoted to protecting and promoting Twombly’s legacy. The Cy Twombly Foundation now finds itself embroiled in a lawsuit that was filed on Wednesday, March 13, 2013 in a Delaware state court.

The lawsuit claims that Thomas H. Saliba, one of the four individuals in charge of the foundation, took over $300,000 in unauthorized fees for investment services and assisted another foundation director, attorney Ralph E. Lerner, in pocketing funds. The claim was filed by Nicola Del Roscia, Twombly’s companion and the foundation’s president, and Julie Sylvester, a curator, Twombly expert, and the foundation’s vice president. Roscia and Sylvester also assert that Lerner and Saliba inflated the value of Twombly’s works in order to pad commissions for their own financial gain. Lerner and Saliba have refused to disclose their trustee commissions, making it impossible to determine the extent of their wrongdoing.

The recent lawsuit comes a month after Lerner asked the same Delaware court to appoint Twombly’s son, Alessandro, as a fifth board member in order to break the stalemate over the dispute. Roscia and Sylvester stated in recent court filings that Lerner’s request was an attempt to outmaneuver them. Roscia and Sylvester claim that Lerner hoped to bring Alessandro, the third trustee of Twombly’s trust, on board to help cover up Saliba’s wrongdoing.

While Twombly is a powerful force in the art market, highly inflating the prices of his work could prove dangerous for the foundation by creating confusion about the true value of his art and in turn destabilizing the Twombly market.

China’s art market experienced a substantial boom in 2011, bumping the United States out of its top spot and ultimately becoming the world’s principal market for art and antiques. In 2012, amid the uncertain global economy, China’s growth began to slow and its art and antiques market shrank by almost a quarter. This deceleration allowed the U.S. to regain its title as the world’s most significant art market.

The power shift was announced as part of the highly anticipated TEFAF Art Market Report compiled by Dr. Clare McAndrew. McAndrew, a cultural economist who specializes in the fine and decorative art market, is the founder of Arts Economics, a company commissioned by The European Fine Art Foundation to provide a yearly analysis of the worldwide art market. The report coincides with the beginning of TEFAF Maastricht, the Foundation’s annual art fair, which begins March 15, 2013 in the Netherlands and runs through March 24, 2013.

Slowing economic growth and a lack of high quality, high priced items on the market are to blame for China’s slip to the second most influential art market. While auction sales dropped by 30% in China, U.S. sale figures were up 5% to $18.4 billion. In 2012, buyers opted to minimize financial risk by buying works by well-known artists at the top end of the market with Post-War and Contemporary art performing the strongest.

Dr. McAndrew will present her findings at the TEFAF Art Symposium on Friday, March 15, 2013 in Maastricht.

In 2006 The Cardsharps was sold to the late collector and scholar Sir Denis Mahon for just over $65,000 at an auction at Sotheby’s in London. At the time of the sale, Sotheby’s identified the work as being by a “follower” of the Italian master, Caravaggio (1571-1610). However, after his purchase, Mahon identified the work as a Caravaggio original and obtained an export license for the work that put its value at $15.5 million according to a claim filed at London’s High Court of Justice.

Due to their failure to identify The Cardsharps as an authentic Caravaggio painting, Sotheby’s is being sued by Lancelot William Thwaytes, who consigned the work to the 2006 auction. Thwaytes is now seeking unspecified damages, interest, and costs relating to the price difference between the painting’s 2006 selling price and what he believes it was actually worth on the open market that year had it been properly attributed to Caravaggio. Thwaytes claims that Sotheby’s was negligent in its research prior to the work’s sale, leading to its extraordinarily low selling price.

However, Sotheby’s stands behind its belief that the painting is a copy and not a work by Caravaggio’s hand, citing Caravaggio expert Professor Richard Spear and several other leading scholars. Sotheby’s added that their view was supported by the market’s reception to the painting when it was put up for auction.

Mahon, who passed away in 2011, donated 58 works from his collection worth around $155 million to various U.K. galleries.

Last week at Sotheby’s auction house in London, Gerhard Richter’s Abstraktes Bild (809–4) sold to a telephone bidder for $34.2 million, the highest price paid for a living artist’s work at auction. Previously owned by musician and collector, Eric Clapton, the abstract painting was estimated to bring $14.1 million to $18.8 million.

Alex Branczik, Senior Director and Head of the Evening Auction of Contemporary Art, said, “The combination of outstanding provenance and gold-standard quality in this sublime work by this blue-chip artist made for an historic auction moment. Gerhard Richter’s international appeal as one of the hottest Contemporary artists was once again confirmed this evening.”

The German postwar painter, best known for his abstract and figurative works, was recently the subject of a critically acclaimed retrospective, Gerhard Richter: Panorama, at the Tate Modern in London, the Pompidou Center in Paris, and the Staatlichen Museum in Berlin. After the show, the prices of Richter’s works have continued to climb.

Friday’s sale beat out Jasper Johns’ Flag painting from the 1960s, which brought $28.6 million at Christie’s in 2010, for a living artist at auction. Richter, 80, lives in Cologne, Germany.

Sotheby’s hosted a number of sales in Hong Kong this past week. On October 7th, the Modern and Contemporary Southeast Asian paintings sale achieved $15.5 million, soaring past the pre-sale estimate of $5.8 million. The sale achieved the highest auction total for this category and the painting Fortune and Longevity by Lee Man Fong, an Indonesian modern master, set a record for any Southeast Asian painting when it sold for $4.4 million. The final price for the painting was almost three times the pre-sale estimate.

The Contemporary Asian Art sale totaled $15.1 million and Tiananmen No. 1 by Chinese symbolist and surrealist painter, Zhang Xiaogang, was the top lot at $2.69 million. Liu Wei’s Revolutionary Family Series – Invitation to Dinner was the second highest sale at $2.24 million, a world record price at auction for the Beijing-based artist who works in various mediums including video, installation, drawings, sculpture, and painting.

The 20th Century Chinese Art sale brought in $24.6 million and sold 90% by lot. Works from Europe, the United States, and around Asian sold well and many were above their pre-sale estimates. The top lot was Potted Chrysanthemums by the Chinese modern art pioneer, Sanyu, which sold for $3.99 million.

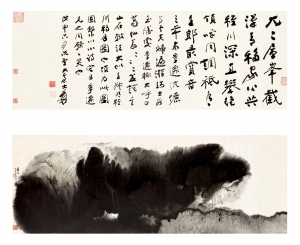

The following day, the Fine Chinese Paintings sale totaled $53.2 million, the highest of the four art auctions. Offering many works from private collections, the total sale was more than double the pre-sale estimate and sold 97.2% by lot. The two top lots at the auction, Zhang Daqian’s Swiss Peaks; Calligraphy in Xingshu and Fu Baoshi’s Lady at the Pavillion, both sold for $2,974,278.

Last year China beat out the United States as the world’s largest art and antiques market and the autumn sales reflect that power swap. There was a bit of controversy when a 60-year-old Taiwanese Buddhist sister demanded that a $1.65 million sale be halted at the Fine Chinese Paintings auction. Sotheby’s canceled the sale of a painting by Zhang Daqian after Lu Chieh-chien requested a court hearing to prevent bidding on Riding in the Autumn Countryside (1950) which she claims was the property of her family and had been consigned without consent.

While sales totaled $3,486,127 million at Sotheby’s American Paintings, Drawings, and Sculpture auction on September 28th in New York, 35% of lots went unsold. Sotheby’s did slightly better than Christie’s in the American Art arena, but both sales are a testament to the lackluster performance of mid-season auctions.

“Sotheby’s did put a few more important paintings in the sale,” said Debra Force of Debra Force Fine Art, Inc. “The question is whether the clientele is there to buy it.” It appears that the clientele interested in purchasing Rockwells were at least in attendance. Is He Coming? (1919), a quintessential Norman Rockwell painting of a young boy and his dog peering up the chimney on what appears to be Christmas Eve, brought in $602,500. The final price was $300,000 more than than the paintings high estimate ($200,000–$300,000).

Sotheby’s sale featured more than 200 paintings, drawings, and sculptures and included property from two noteworthy private collections belonging to Margie and Robert E. Petersen and Susan Kahn Rosenkranz and Richard Rosenkranz. Highlights included works by Rockwell Kent, Marsden Harley, Grandma Moses, and Ben Shahn with Kent and Moses taking two of the top five lots. Moses’ On the Banks of the Hudson reached the third highest price of the sale at $92,500 but still brought in considerably less than its high estimate of $120,000. Rockwell Kent’s Adirondack Farm, Summer sold for $86,5000 (estimate: $25,000–$35,000), the fourth highest sale of the auction.

While the highlights of the auction could have made more money in a more important sale, the quality is there. "Maybe more important collectors need to get used to looking at these mid-season sales," says Force.

|

|

|

|

|