|

Displaying items by tag: profits

Sotheby’s, the New York-based auctioneer of art and collectibles, reported a 13 percent decrease in second-quarter profit that fell below analyst expectations because of a change in the sales calendar and a loss on a painting sold during the period.

Net income was $67.6 million, or 96 cents a share, in the quarter ended June 30, compared with $77.6 million, or $1.11, in the same period last year, Sotheby’s said Friday. The company was expected to report earnings of $1.22 a share, according to the average of five analysts in a Bloomberg survey.

Sotheby’s, the auction house under pressure from activist investors to boost profit, doubled the amount it can borrow to make art loans in a bid to win clients and top consignments.

Sotheby’s secured a credit line of more than $1 billion to make such loans from a consortium including General Electric Capital Corp., according to a filing last week. The New York-based auction house previously could borrow as much as $550 million under that line.

Sotheby’s may find itself in a new shareholder fight even as its battle with billionaire investor Daniel Loeb and search for a new chief executive officer proved costly in 2014.

The New York-based auction house said today that profit fell 9 percent in 2014 as expenses increased. Net income fell to $117.8 million, or $1.69 a share in the 12 months ended Dec. 31, from $130 million, or $1.90 a share in the same period last year, Sotheby’s said today in a statement.

According to The Art Newspaper, Christie’s has boosted its seller’s commission in its contracts with consignors. The auction house will now charge 2% of the hammer price of a work that meets or exceeds its high estimate. After the 2% performance fee, Christie’s charges commission using a sliding scale based on a work’s final hammer price.

In order to attract powerful sellers offering blue-chip works, auction houses often waive the seller’s commission for preferred clients. Christie’s new 2% performance fee, which is in addition to the fixed buyer’s premium (the percentage of the hammer price paid by the buyer), ensures that the auction house will receive a portion of the profits from both sides of a blockbuster sale.

The international auction house Sotheby’s reported that their second-quarter profits rose 7 percent, thanks in part to a $6.8 million net income tax benefit recognized by the company. Sotheby’s said that second-quarter profits reached $91.7 million, or $1.33 a share, up from last year’s profit of $85.4 million, or $1.24 a share. Expenses rose 2 percent to $171.6 million for the auction house.

Bill Ruprecht, Chairman, President and CEO of Sotheby’s, said, “Our business and the market for quality art at the high end continue to be strong. We saw significant sales growth in Impressionist, Modern and Contemporary Art and posted the best results in the market in the vast majority of key sales this spring. We continue to see fierce competition for high-end consignments and as a result, lower auction commission margins.”

On July 2, 2013, a U.S. District judge decided the fate of 15 contemporary artworks once belonging to the disgraced financier and attorney, Marc S. Dreier. Dreier was convicted of fraud in 2009 for selling hundreds of millions of dollars in fake promissory notes to hedge funders and a section of his collection has remained in limbo ever since.

Judge Jed S. Rakoff ruled that the art holdings, worth $33 million, will be turned over to New York’s Heathfield Capital Limited, the company that suffered the greatest from Dreier’s scam. The works going to Heathfield Capital include a piece by the conceptual artist John Baldessari (b. 1931), an untitled work by Keith Haring (1958-1990), one work by Alex Katz (b. 1927), three by Roy Lichtenstein (1923-1997), an untitled work by Mark Rothko (1903-1970) and three pieces by Andy Warhol (1928-1987) including the iconic Jackie portrait of Jacqueline Kennedy Onassis. The bulk of Dreier’s collection was sold in 2010 at Phillips and the profits were reserved for creditors of Dreier’s law firm.

Drier is currently service a 20-year sentence at a federal prison in Minnesota.

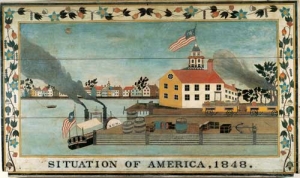

In an effort to curb the massive debts accrued by the American Folk Art Museum’s former chairman, Ralph Esmerian, the institution has decided to sell over 200 works from its collection at an auction at Sotheby’s. Esmerian, the former owner of the jewelry company Fred Leighton, is currently serving a six-year jail sentence for wire fraud and other charges.

In 2005, Esmerian promised to donate 263 works from his illustrious collection to the Folk Art Museum. However, he used some of those same works as collateral to secure multi-million-dollar loans with Christie’s and Sotheby’s. Late last month, Manhattan’s U.S. Bankruptcy Court arranged a settlement with the museum allowing the Folk Art Museum to keep 53 of the promised works as long as they enhance the institution’s collection and aid its educational mission. The remaining works, which include paintings, sculptures, scrimshaw, and needleworks, will be sold at Sotheby’s.

The trustee responsible for liquidating Esmerian’s estate has decided to sell the remainder of the collection through Sotheby’s, much to Christie’s dismay. Christie’s filed an objection to the settlement on March 15, 2013 claiming that Sotheby’s intimidated the trustee into choosing them to host the important auction.

The Esmerian sale will be held in December 2013 or January 2014 and the profits will go towards repaying the creditors the former chairman defrauded.

Two weeks after Christie’s announced that they will be increasing their buyer’s premium, a fee charged to buyers, Sotheby’s revealed that they will raise their commissions as well. It is the first time Sotheby’s has boosted its buyer’s premium since 2008.

Sotheby’s and Christie’s had both been charging 25% for the first $50,000 of a sale, 20% on the amount from $50,000 to $1 million and 12% on the remainder. Sotheby’s new fees will take 25% of the first $100,000 of a purchase, 20% from $100,000 to $1.9 million, and 12% of the rest. While both auction houses are raising commissions, it will be slightly cheaper for patrons to buy at Christie’s as their new fees charge 25% for the first $75,000 of a purchase, 20% on the amount from $75,001 to $1.5 million, and 12% on whatever is left.

Sotheby’s announced the hike on Thursday, February 28, 2013, the same day that the auction house reported a decline in both revenues and profits for 2012. Sotheby’s revenues for the year were $768.5 million, an 8% decrease from the year before. The auction house attributes the decline to a reduction in commissions. In recent years Sotheby’s has given a percentage of the buyer’s premiums to its biggest sellers as an incentive to maintain their business, a practice that also cuts into the auction house’s profits.

Prominent Canadian art collector David Mirvish filed a lawsuit on Friday, February 22, 2013 against the disgraced New York-based art gallery, Knoedler & Company. Since closing its doors in late 2011, Knoedler & Company has been accused by multiple clients of selling forged paintings, which were acquired by the gallery from Long Island dealer Glafira Rosales. Mirvish’s is the fifth lawsuit against Knoedler since 2011.

However, Mirvish’s claim is slightly different than its predecessors. While the other lawsuits accused Knoedler of passing off fake Jackson Pollock (1912-1956), Robert Motherwell (1915-1991), and Mark Rothko (1903-1970) paintings as the real deal, Mirvish claims that the works he purchased from the gallery were authentic. Instead, Mirvish is arguing that he lost out on millions of dollars in profits when Knoedler failed to sell three Jackson Pollock masterpieces he purchased jointly with the gallery.

Between 2002 and 2007 Mirvish purchased two paintings attributed to Pollock and bough a half stake in a third for $1.6 million. The sole purpose of Mirvish’s dealings with Knoedler was to resell the works for a profit. One of the Pollock paintings sold to collector and hedge fund manager Pierre Lagrange for $17 million in 2007, but in 2011, the day before Knoedler shut down, Lagrange announced that he would be filing a lawsuit against the gallery as forensic testing suggested the painting was a fake. The Lagrange suit was eventually settled but Mirvish was not involved and refused to return the money he made off of the deal.

Mirvish is now seeking reparations for the two unsold Pollocks, claiming that Knoedler breached its agreement when the gallery suddenly went out of business. Mirvish is asking Knoedler to return the two paintings, referred to as “Greenish Pollock” and “Square Pollock,” as well as reimburse him for his $1.6 million stake in the third painting, referred to as “Silver Pollock.” Even though Mirvish only paid Knoedler $3.25 million, half of “Greenish Pollock” and “Square Pollock’s” purchase prices, he claims that Knoedler’s violation of contract entitles him to both paintings.

Nicholas Gravante, the lawyer of Knoedler’s former president, Ann Freeman, is representing Mirvish. Freeman is not named as a defendant in Mirvish’s case and she has maintained that all works acquired from Rosales are genuine. Rosales is currently under investigation by the F.B.I.

Christie’s announced that they will be raising their buyer’s premium, a fee charged to buyers at auction, for the first time since 2008. The auction house had been charging 25 percent for the first $50,000 of a sale, 20 percent on the amount from $50,001 to $1 million, and 12 percent on the remaining price. The increase, which will go into effect on March 11, 2013, will bring the charges up to 25 percent for the first $75,000, 20 percent on the amount from $75,001 to $1.5 million, and 12 percent on the rest.

In recent years auction houses have started offering certain sellers a percentage of the buyer’s premiums, which can result in lower profits for the auction companies but ultimately brings in more business. Last month Christie’s announced that its sales for 2012 totaled $6.27 billion, a 10 percent increase from its 2011 sales. While no other auction houses have announced increases in buyer’s premium, it has been a trend among them in the past.

|

|

|

|

|