New York’s Whitney Museum of American Art, which is borrowing for the first time to build a new site in lower Manhattan, pared back yields after investors placed orders for more than twice the $125 million offering.

“Institutional investors have plenty of room for this name because they don’t have any credit exposure to it,” said Fred Yosca, head of fixed-income trading at BNY Mellon Capital Markets LLC in New York.

The securities, rated A, the sixth-highest grade from Standard & Poor’s, yielded 3.7 percent for $50 million of debt due July 2021, the largest portion. Morgan Stanley, the underwriter, lowered yields on three different maturities, including a 0.13 percentage point cut to 4.87 percent on the 20- year bonds, according to a person familiar with the transaction who declined to be identified because the person wasn't authorized to speak publicly on the deal.

Strong demand prompted Morgan Stanley to compress the offering period to one day from two, the person said. More than 21 investors offered a total $286 million in orders while individuals were alloted $57.5 million, the person said.

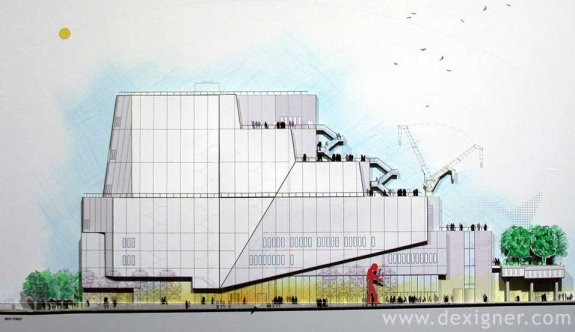

The Whitney, founded in 1931 and specializing in contemporary U.S. art, has a “non-binding memorandum of understanding” from New York’s Metropolitan Museum of Art for it to assume operating costs at the Whitney’s Madison Avenue building, according to the bond offering document. The Whitney expects the arrangement to be final later in the year, and last for eight years beginning in 2015, when the museum opens its downtown space.

Museum Deals

The Met and the Whitney announced their deal May 11, the day after the Museum of Modern Art agreed to buy the headquarters of the American Folk Art Museum, which is in default on bond payments.

The new location, which will be more than twice the size of the Whitney’s current space, is expected to boost the museum’s average annual attendance to 720,800 in fiscal 2016 from 392,324 a year during fiscal years 2008 to 2010, Fitch Ratings said in a June 30 report.

The Whitney will depend on gifts and contributions to pay its debt principal. Its interest-only debt burden will reach 21 percent of its expenses, said Joanne G. Ferrigan and Douglas J. Kilcommons, Fitch analysts, in the report.

The museum’s endowment totaled $185.6 million as of June 30, according to offering documents. It expects to raise $625 million from its capital campaign by 2015. As of last month, it had pledges of $411 million, or about 66 percent, the documents said. The Whitney anticipates full payment of those pledges by 2020, 11 years before the final maturity of the bonds.