The $10 billion market for Chinese antiques is about to be transformed by the unexpected fallout from an auction at a saleroom in a suburb of London.

An 18th-century vase found in a house clearance, bid to an auction record for any Chinese artwork, has become the biggest example of slow payments from Chinese buyers. With no payment reported by Bainbridges for the 51.6 million pound ($83.2 million) Nov. 11 sale, other auction houses yesterday told Bloomberg that they are demanding deposits from would-be buyers.

The deposits will safeguard sellers, while deterring some bidders and potentially cooling prices at a time when the Asian market is growing faster than that in the U.S. and U.K.

“There must be a problem with payment, otherwise the auction houses wouldn’t do this,” the London-based dealer John Berwald said. “It’s a difficult balance to strike between being stringent with the buyers and not making them discouraged.”

China overtook the U.S. as the world’s biggest auction market for fine art last year, according to research company Artprice. Chinese sales of antiques were alone valued at 6 billion euros ($8.6 billion) and grew 160 percent year-on-year, according to a European Fine Art Foundation report published last month. Further auctions and dealer transactions in the West have turned the trade in Chinese artifacts into a business worth more than $10 billion, according to Bloomberg calculations.

Growing Millionaires

Buying at auctions of Asian art in Europe and the U.S. is now routinely dominated by bidders from China, which last year became the world’s second-biggest economy. The country’s growing number of millionaires is bidding to unprecedented levels to repatriate works of art, particularly when they have Imperial associations. Some bidders have been reluctant payers, said dealers.

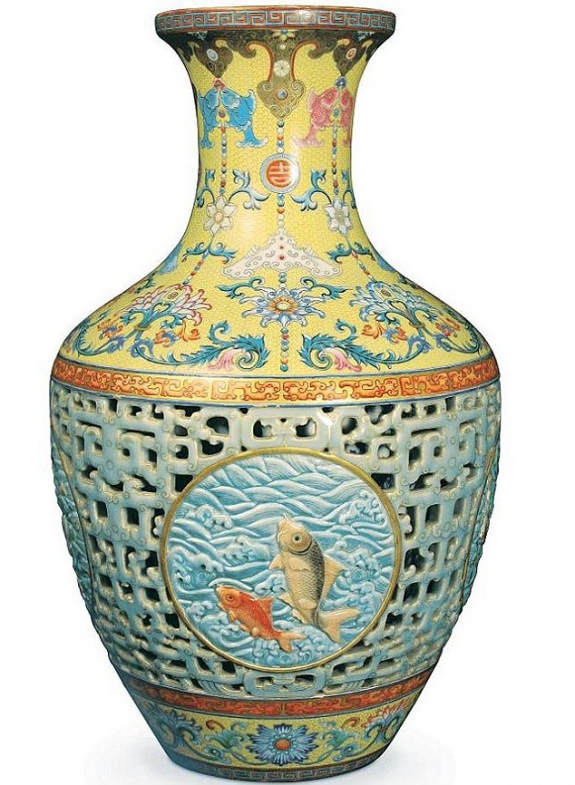

In the London sale, auctioneer Peter Bainbridge broke his hammer after spending half an hour taking bids from an excited crowd of more than 40 Chinese collectors, dealers and agents that had traveled to Ruislip in the hope of buying an elaborately decorated vase that had once been owned by the Qianlong Emperor.